Over 3 million labourers in HCM City subjected to unemployment insurance allowances

Nearly 3 million labourers in Ho Chi Minh City will benefit from the unemployment insurance fund with total allowances of about 6 trillion VND (263.92 million USD), according to Phan Van Men, Director of the city Social Insurance agency.

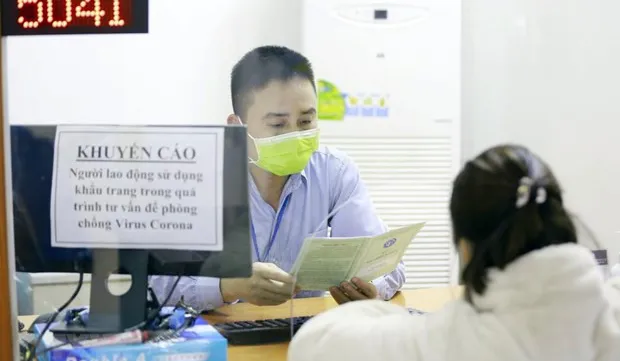

They include employees of 84,000 businesses and those with unemployment insurance premium payment period reserved. Men said that due to COVID-19, HCM City has the number highest of unemployed labourers and labourers on unpaid leave in the country. Along with reducing employees’ unemployment insurance premium from 1 percent of their wage funds to zero percent, the city is promptly implementing a 1.9 trillion VND (83.56 million USD) package to support pandemic-hit enterprises, he said.

On October 1, the Government issued Decision No. 28/QD-TTg providing regulations on the implementation of support policies for employees and employers impacted by the COVID-19 pandemic, using the unemployment insurance fund. Accordingly, different levels of allowances from 1.8 million VND (79 USD) to 3.3 million VND (144.8 USD) will be given to each labourer depending on the time they has paid unemployment premiums.

On September 30, the National Assembly also issued a resolution on the provision of allowances to employees and employers affected by COVID-19 using the unemployment insurance fund.

Under the resolution, about 30 trillion VND (1.31 billion USD) from the fund will be used to support labourers who are covered by unemployment insurance as of September 30, 2021, excluding employees in State agencies, socio-political organisations, people’s armed forces and public non-business agencies who are paid by the State budget.

Labourers who have stopped paying unemployment insurance due to the termination of their labour contracts or working contracts between January 1, 2020 and September 30, 2021, and have unemployment insurance premium payment period reserved in accordance with the employment law, are also eligible for the support, excluding retirees who receive monthly pensions. The support will be delivered from October 1 and scheduled to complete on December 31 at the latest.

The resolution clarifies that employers, excepting State agencies, socio-political organisations, people’s armed forces and public non-business agencies funded by State budget, who are joining unemployment insurance before October 1, 2021, will have their premiums reduced from 1 percent of their wage funds to zero percent for a duration of 12 months from October 1.