Stocks fall after two days of growth

|

| Investors at FPT Securities JSC’s trading house on Hàn Thuyên Street, Hà Nội. |

HÀ NỘI — Vietnamese shares declined on Thursday as investors worried about the short-term prospects of global stocks.

In addition, the two-day increase of the stock market triggered profit-taking among investors.

The benchmark VN Index on the HCM Stock Exchange fell 0.84 per cent to close at 963.47 points.

The southern market index had gained a total 2.1 per cent in the previous two sessions.

The HNX Index on the Hà Nội Stock Exchange lost 1.35 per cent to end at 107.91 points.

The northern market index had increased by total 1.6 per cent in the previous two trading days.

More than 186 million shares were traded on the two local exchanges, worth VNĐ3.8 trillion (US$169 million).

Stocks across the two exchanges were hit by profit-taking pressure after the market had increased for two straight days before.

Market breadth was negative with 166 gaining stocks against 281 declining.

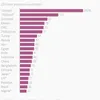

Among the 30 largest stocks by market capitalisation in the VN30 Index, 22 fell while only four advanced.

The VN30 Index was dragged down 0.88 per cent to touch 937.54 points at the end of the day.

Decliners in the VN30 basket included Binh Minh Plastic JSC (BMP), PetroVietnam Gas (GAS), Vietcombank (VCB), MBBank (MBB) and budget carrier Vietjet (VJC).

The 22 declining stocks in the VN30 basket were down between 0.2 per cent and 2.5 per cent.

On a sector basis, 17 of the 20 industry indices ended in negative territory.

"Bad news from the US stock market on Wednesday overnight was clearly the main reason for the Vietnamese stocks to retreat from their two-day increases," Sài Gòn-Hà Nội Securities JSC (SHS) said in its daily report.

It’s clear what is weighing on the market sentiment in the next few days is the US central bank Fed’s Friday meeting, and investors are cautious and unwilling to make new purchases, SHS added.

In addition, investors are waiting for more signals from the local stock market as market trading liquidity continued to be lower than the average of the previous 20 trading days, proving investors were unwilling to take part in trading, SHS said.

"Technically, the range of 970-990 points would be a strong resistance zone in the next sessions and if the VN Index could reach that level, it would trigger profit-taking for investors again," SHS added. — LV

Tags: