Finance and banking system embraces digital transformation

by ,http://vietnamnews.vn/economy/538185/finance-and-banking-system-embraces-digital-transformation.html09 November 2019 Last updated at 08:59 AM

HÀ NỘI — Digital transformation would push Việt Nam’s finance-banking system in the years to come, helping it catch up with global standards, said Deputy Governor of the State Bank of Vietnam Nguyễn Kim Anh.

Speaking at the Vietnam Finance Forum 2019 held in the northern province of Quảng Ninh on Friday, Anh said it was the right time to promote digital transformation in the finance-banking system whilst the country’s economy was enjoying high growth.

Some credit institutions have already taken the initiative to research and apply financial technology solutions to optimise products and services.

Anh said accompanying the traditional financial and banking system in the digital transformation process were financial technology companies (Fintech), who would help the Government achieve its socio-economic development goals.

“Việt Nam has witnessed a dramatic increase in the number of new businesses, especially start-ups, in recent years. In the past four years, the number of Fintech companies has increased from 40 to about 150,” Anh said.

He said the figures showed the dynamism of the businesses, especially start-ups in Việt Nam, where the business environment was improving. Many management agencies, including the central bank, had helped create a legal framework for the development of technology and management capacity.

At the forum, experts from the central bank, World Bank, Asian Development Bank, Visa and MasterCard shared different perspectives on the digital transformation process in banking operations, technology support and development policies, cyber security and automation of financial - banking services.

Asian Development Bank (ADB) Country Director in Vietnam Eric Sidgwick said new technologies had great potential in increasing access to finance for those who had not or had limited access to banking services.

It also enhanced efficiency and financial security in a rapidly growing market like Việt Nam, he said.

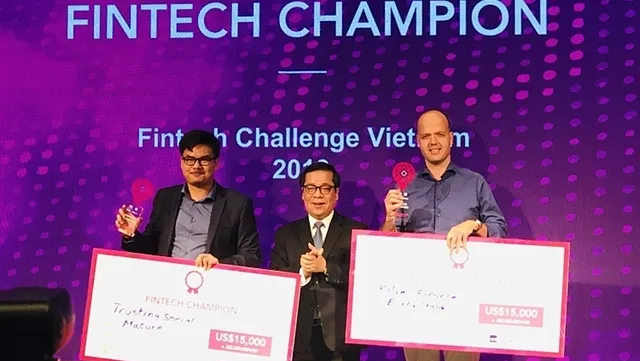

The FVF’s organising committee also announced the results of the Fintech Challenge Vietnam 2019 competition. Through this contest, the State Bank will capture new service solutions and digital transformation trends to build policy mechanisms and issue management regulations, creating a favourable environment for innovation.

Three Vietnamese representatives made it into the top six winners, with total prize value of US$55,000.

In the prizes for mature fintech companies, Việt Nam’s Trusting Social took the first prize for its use of data science and artificial intelligence to provide financial services to everyone, including those with little access to banking services. Trusting Social currently owns the largest source of credit score data in Asia.

The second prize went to Singapore’s Tookitaki, which is a cybersecurity company that provides solutions to help monitor transactions and manage regulatory compliance based on machine learning for clients in the financial sector. The third place went to Việt Nam’s Interloan, whose peer-to-peer (P2P) lending platform provides users with solutions for salary advances and microinvestment opportunities.

For early-stage fintech companies, Việt Nam’s Kilimo Finance won first place, followed by Singapore’s Staple and India’s Touchless ID. — VNS